does nj offer 529 tax deduction

Some states do not offer state tax deductions or tax credits for K -12 tuition and other restrictions may apply. The technology platform that houses.

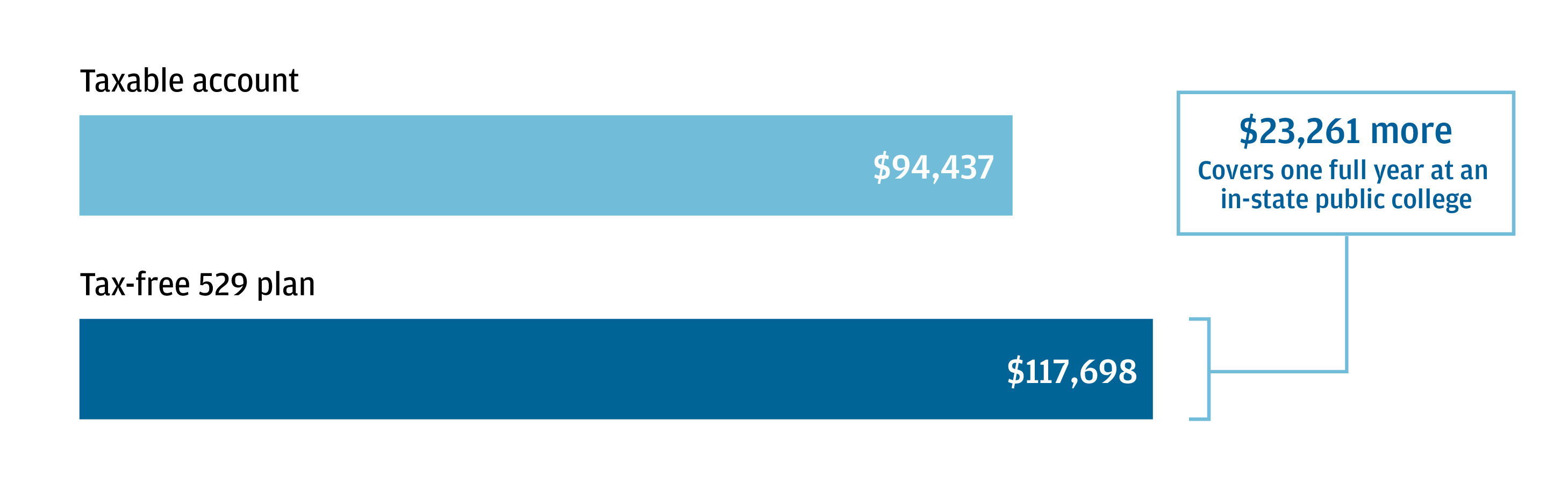

Saving For College 529 Plans Versus Everything Else

Not all states offer a tax deduction for contributions to a 529 college savings plan.

. Does Nj Offer 529 Tax Deduction. Now New Jersey taxpayers with gross income of 200000 or less can qualify for a state income tax deduction of up to 10000 per taxpayer for contributions to the plan. NJBEST 529 College Savings Plan is a traditional NJ 529 plan that allows you to invest money today and reap tax benefits when you withdraw it to pay for.

Ohio residents can deduct up to 4000 per beneficiary per year on their state taxes. Section 529 - Qualified Tuition Plans. 5000 single 10000 joint.

Contributions to such plans are not deductible but the money grows tax-free while it. But if you live in New York and pay New York state income taxes you may be able to deduct the contributions. New Jerseys plan doesnt offer much.

Depending on where you live or where you started your 529 plan you could be eligible for one of these benefits. There are 249350 registered schools in New Jersey. Njbest 529 college savings plan is a traditional nj 529 plan that allows you to invest money today and reap tax benefits when you withdraw it to.

A 529 plan is designed to help save for college. Oklahoma allows individuals to deduct up to 10000 per year and joint filers to deduct. The size of the break varies.

NJBEST New Jerseys 529 College Savings Plan is offered and. Tax Deductions for New Jersey Families Unlike traditional IRAs and 401ks 529 plan contributions are not tax deductible at the federal level. The plan NJBEST is offered through Franklin Templeton.

If your state does and you want to set up a 529 plan to capture the tax savings talk to the plan. New Jersey does not offer a deduction for 529 plan contributions. Many states provide an income tax deduction for contributing to a college savings plan including New York which provides a maximum annual 10000 deduction.

Thanks to recent legislation. New Jersey 529 Plan Statistics. Most 529 plans offer a state income tax break in the year you contributed.

New Jersey offers tax benefits and deductions when savings are put into your childs 529 savings plan. NJBEST 529 College Savings Plan. As of January 2019 there are no tax deduction benefits when making a.

What Is A 529 Plan Marcus By Goldman Sachs

Tax Benefits Nest Advisor 529 College Savings Plan

Education Savings Accounts Coverdell Esa Vs 529 Plans Vision Retirement

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2021 My Money Blog

Tax Deduction Rules For 529 Plans What Families Need To Know College Finance

Nj College Affordability Act What You Need To Know Access Wealth

Will N J Ever Allow Deductions For 529 Plan Contributions Nj Com

How Do I Choose A 529 Morningstar 529 College Savings Plan College Savings Plans Saving For College

What States Offer A Tax Deduction For 529 Plans Sootchy

How Much Is Your State S 529 Plan Tax Deduction Really Worth Savingforcollege Com

529 Plan Tax Benefits J P Morgan Asset Management

Direct Portfolio College Savings Plan Colorado 529 College Savings Plan Ratings Tax Benefits Fees And Performance

How Much Can You Contribute To A 529 Plan In 2022

The New Jersey 529 Plan Everything You Need To Know

3 Reasons To Invest In An Out Of State 529 Plan

New Jersey Deductions For Higher Education Expenses And Savings Kulzer Dipadova P A

Does Your State Offer A 529 Plan Contribution Tax Deduction

A Tax Break For Dream Hoarders What To Do About 529 College Savings Plans