tax planning services fees

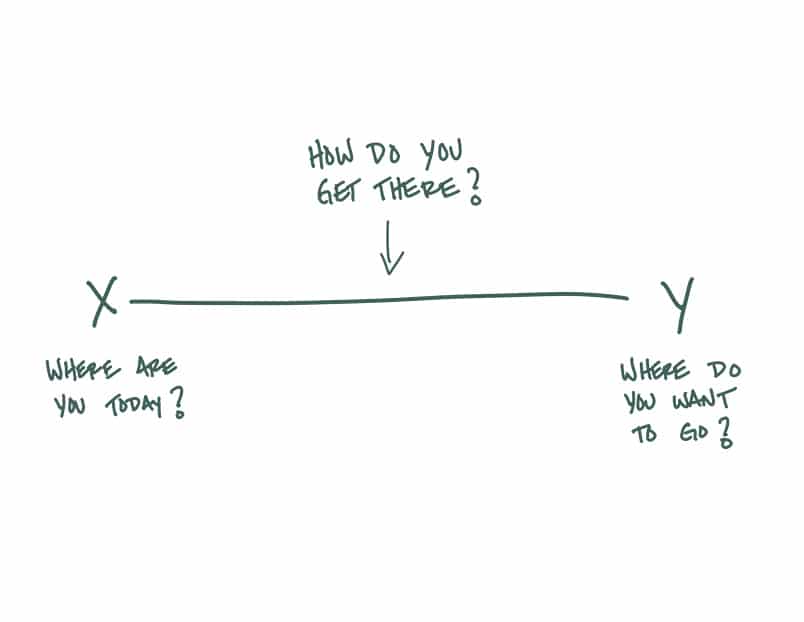

Without proper planning you could be leaving thousands of dollars on the table both now and when you withdraw from your portfolio in retirement. Schafer Associates CPA provides tax planning strategies that align with your wealth management goals.

Business Tax Planning Services Method Cpa Business Accounting

Quarterly Quickbooks Review and Reconciliation.

. Before the TCJA the Internal Revenue Code Section 212 allowed individuals to deduct all the ordinary and necessary expenses incurred in the production of income which. After the initial planning process we will typically meet twice a year to review your financial life plan and update as needed. Unfortunately due to the Tax Cuts and Jobs Act of 2017 TCJA fees you pay for estate planning are no longer deductible.

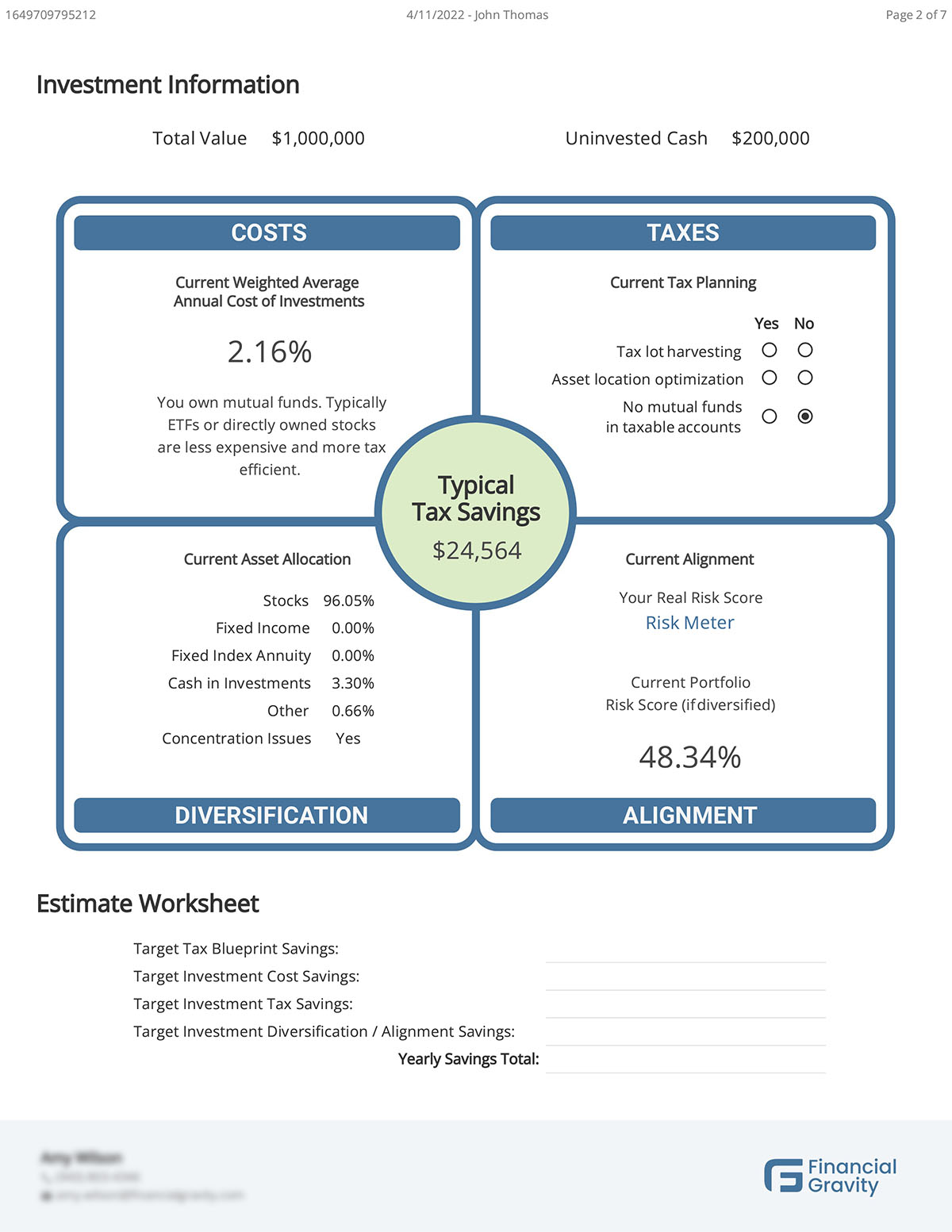

Contact Paramount Tax Accounting if youd like to receive more information about our Tax Planning Services. Consultation 250 per hour. Fees for tax planning and advisory services average as much as five times those for tax preparation according to a recent survey of practitioners.

As such the tax planning for determining the efficacy of using this tax deduction is challenging. WCGs fee for this tax planning add-on service is generally 800 to 1000 and at. A fee based on the subjective value of the tax preparation.

However the tax service fee is less. A minimum fee plus an amount based on the complexity of the clients return. Our University Fees Tax Planning service is a non-aggressive tax saving solution that enables those sending their children to university to dramatically reduce.

Many of our clients save many times the fee in reduced. Free 3-Year Tax Review Pay Our Fee Find a Location 801-890-4777 Schedule. If youre careful structured legal fees can allow tax-free compounding defer taxes and help build a solid financial plan.

As of five years ago estate planning fees used to be tax deductible. Tax planning is usually bundled with tax prep and other services for a quarterly fee such as 2750. The tax service fee is one of a variety of closing costs or fees assessed when a mortgage becomes official and a home sale is completed.

Our flat fee financial planning and investment management. How much does tax relief services. Small businesses average per quarter 175-500.

Call us now at 843-942-1777 to fix all your tax problems. The study from Intuit. Irs Resolution Audit Support 250 per hour.

Tax planning financial advisors may charge 100 to 400 an hour depending on their level of professional certification and experience and the complexity of the. Certified Public Accountant CPA 250 per hour. A set fee for each tax form or schedule.

Our tax planning services aim to reduce. 250 for up to 1 hour of time with CPA. Rudd Company offers tax planning services in Rexburg ID Idaho Falls ID West Yellowstone MT Bozeman MT and Helena MT.

Understanding Tax Planning Services From Financial Advisors Smartasset

Tax Preparation Services Milwaukee Am Accounting Tax Services Llc

5 Ways To Tell You Need A New Tax Planning Service Shockley Books

Tax Planning Service In El Paso Tx Individual Tax Prep Marcfair Com

The Wealthquest Financial Path All In One Financial Services In Cincinnati Dayton Oh Wealth And Asset Management In Chicago Il And Naples Fl Wills And Estate Planning Near

Tax Planning Financial Services Fee Only Financial Advising Wealth Managment Retirement Planning Pathway Financial Advisors

Federal Tax Services Federal Tax Representation Sikich Llp

Gogo Tax Preparation Fees Gogo Tax Service

West Hartford Tax Preparation Ct Tax Accountants

Formal Tax Planning Services Las Vegas Tax Professional Las Vegas

Tax Preparation Services In Minneapolis Mn Johnson Goff Pllc

:max_bytes(150000):strip_icc()/hrblock_logo1-c3a5cbb43e1245aabb0e7d9b5df074ae.jpg)

The 5 Best Tax Preparation Services Of 2022

Lottsa Tax Accounting Services Tax Planning

Estate Trust Tax Preparation Atlanta Marietta Peachtree Corners Ga Certified Cpa

Financial And Tax Analyst Planning Services Tax Master Network

Serene Financial Solutions Tax Planning And Preparation Services

Intuit Accountants Releases Tax Planning And Advisory Insights Survey Tax Pro Center Intuit