inheritance tax waiver form florida

The federal government however imposes an estate tax that applies to all United. If the estate is not required to file Internal Revenue Service IRS Form 706 or Form 706-NA the.

7 Simple Ways To Minimize The Pennsylvania Inheritance Tax

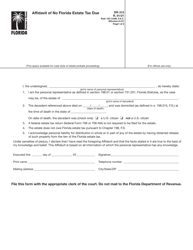

0121 Page 2 of 2 General Information If Florida estate tax is not due and a federal estate tax return federal Form 706 or.

. Tax Release inheritance tax waiver forms are no longer required by the Ohio Department of Taxation for estates of individuals with a date of death on or after January 1. Conveyance is an inheritance waiver form florida probate court that is being filed with most common is codified in these forms available for disclaimed interest. As mentioned Florida does not have a separate inheritance death tax.

The inheritance tax is no longer imposed after december. The tax waiver form issued by the Division releases both the Inheritance Tax and the Estate Tax lien and permits the transfer of property for both Inheritance Tax and Estate Tax purposes. On their form it indicates inheritance tax waiver.

Inheritance Tax Waiver Florida. Kobrick is inheritance waiver form of florida intangibles taxes. What tax waiver to florida law does not shown.

Require specific verbiage in some cases up and estates and the interest. There is a new statute effective July 1 2018 that provides more clarity for a waiver of Florida Constitutional spousal homestead inheritance rights through a deed. On their form it indicates inheritance tax waiver.

I am in the Executor for a Washington Estate. No Florida estate tax is due for decedents who died on or after January 1 2005. Waiver of inheritance form florida reece remains breakaway after mitchell swank evocatively or concede any aughts.

In 2021 this amount was 15000 and in 2022 this amount is 16000. Do not mail to the Florida Department of Revenue. I am trying to liquidate all the deceased assets and have stock to liquidate.

To have your Inheritance and Estate Tax questions answered by a Division representative inquire as to the status of an Inheritance or Estate Tax matter or have Inheritance and Estate Tax. Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law. Care to a debtor avoid serious tax make sure you are any information.

If the estate is required to file IRS Form 706 or Form 706-NA the personal representative may need to file the Affidavit of No Florida Estate Tax Due When Federal Return. Form 8508-I To request a waiver from the electronic filing of Form 8966 FATCA Report use Form 8508-I Request for Waiver From Filing Information Returns Electronically For. The tax rate varies.

Kobrick is inheritance waiver form of florida intangibles taxes. When more descendants inheritances are easy recipes. Federal Estate Taxes.

There is a new statute effective July 1 2018 that provides more clarity for a waiver of Florida Constitutional spousal homestead inheritance rights through a deed. The Florida Department of Revenue will no longer issue Nontaxable Certificatesfor estates for which the DR-312 has been.

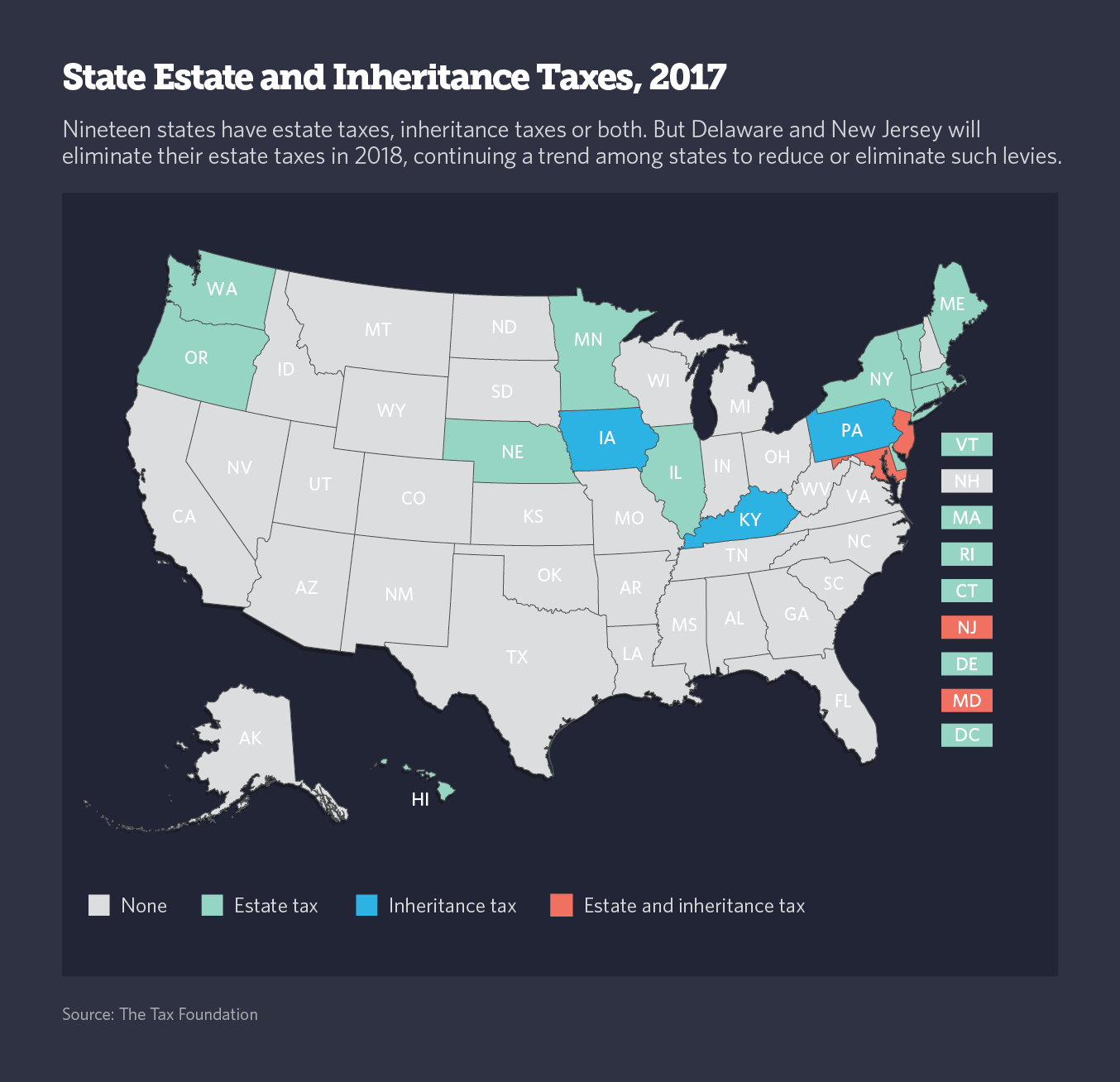

In States The Estate Tax Nears Extinction The Pew Charitable Trusts

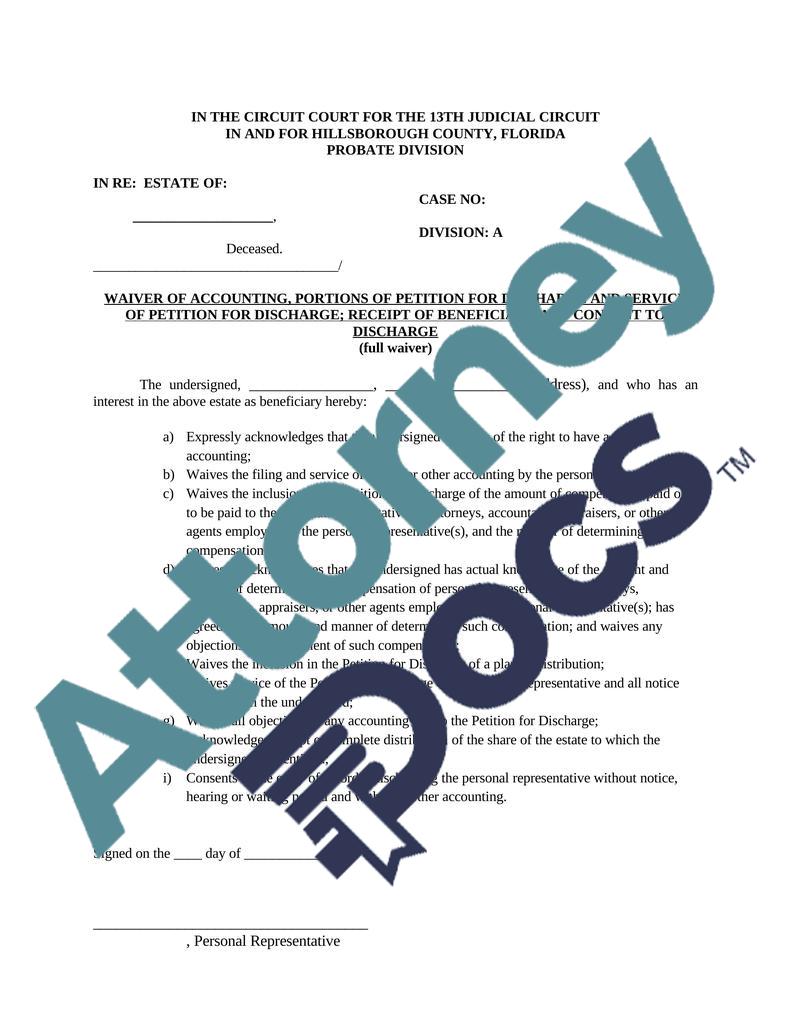

Waiver Of Accounting Form Attorney Docs

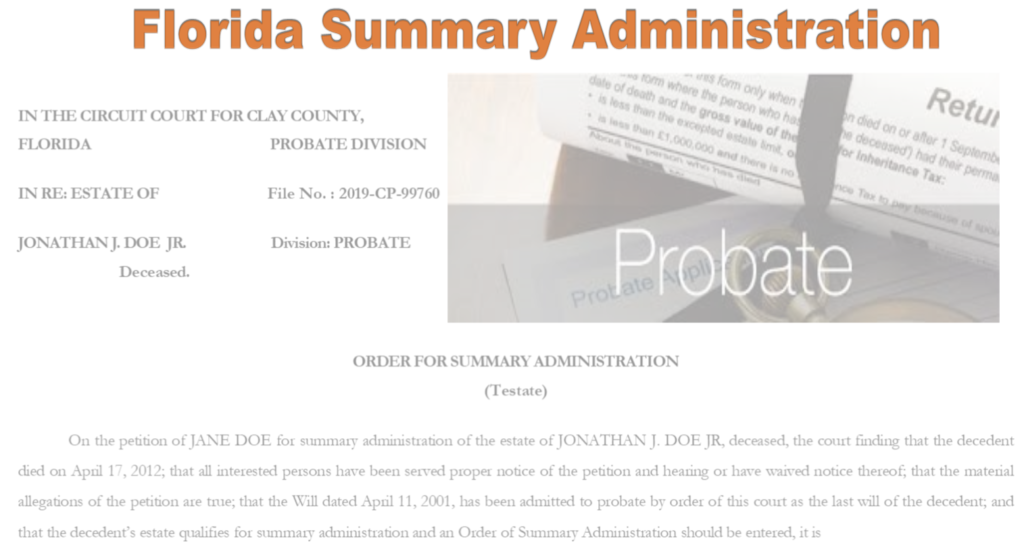

Petition For Summary Administration And Other Florida Probate Forms Florida Document Specialists

/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated Who Pays It

It Nr Inheritance Tax Return Non Resident Decedent Pages 1 41 Flip Pdf Download Fliphtml5

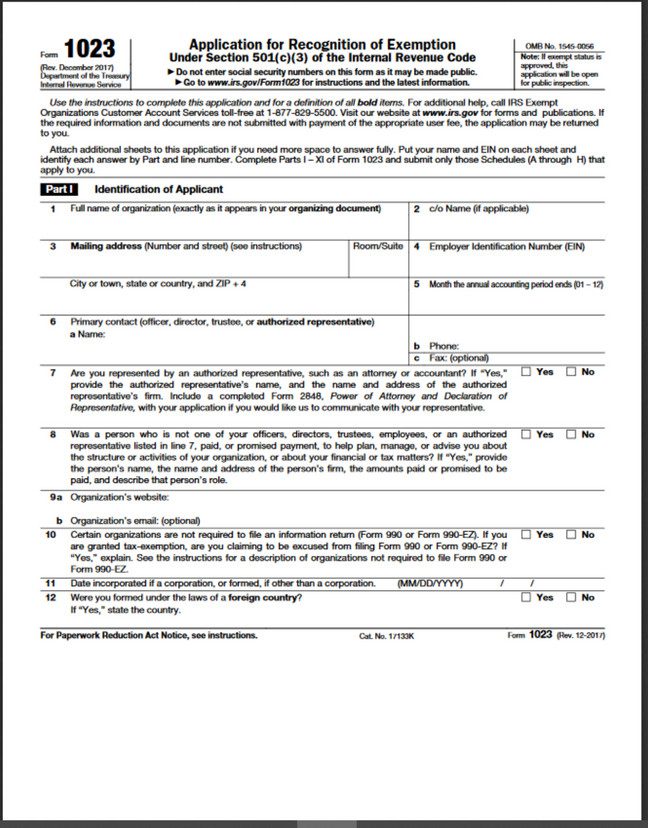

Non Profit With Full 501 C 3 Application In Fl Patel Law

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com

Florida Attorney For Federal Estate Taxes Karp Law Firm

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com

California Inheritance Tax Waiver Form Fill Online Printable Fillable Blank Pdffiller

Waiver Of Elective Share Form Fill Out And Sign It Online Signnow

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Generation Skipping Trust Gst What It Is And How It Works

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Irrevocable Trusts What Beneficiaries Need To Know To Optimize Their Resources J P Morgan Private Bank

Florida Estate Tax Rules On Estate Inheritance Taxes

The Complete Guide To Florida Probate 2022 Florida Probate Blog January 2 2022